AI research reveals Energy Transition is the biggest ESG topic.

Environmental, Social, and Corporate Governance (ESG) is a criterion used to measure an investment’s sustainability and societal impact. ESG investing considers how companies integrate sustainable consumption of natural resources, workforce diversity, and prudent corporate governance principles into their business model. It very much broadens and deepens what was previously called Corporate Social Responsibility (CSR). Currently, there is a lot of debate into what ESG investing actually means, with many organisations giving their own take on what constitutes the term.

Using AMPLYFI’s AI-driven insights platform, we have analysed unstructured data to reveal unique insights into the ESG investment landscape. Our technology leverages machine learning (ML) and data science to deliver insights by connecting structured and unstructured data at scale to uncover previously hidden links, trends, and opportunities. Taking thousands of documents centred around ESG investing, we have been able to pick out and quantify the most significant topics of discussion, building a holistic and comprehensive picture of what ESG investing looks like.

In 2004, Kofi Annan, former Secretary-General of the UN, established the UN Principles of Responsible Investing. The Principles were a call to the top 55 CEOs globally to consider investors’ interests (profit) against environmental, social, and corporate governance issues. Demonstrating an industry shift in recognition of the importance of ESG-related issues, industry-leaders such as Blackrock, Morgan Stanley, and JP Morgan were among the 55 institutional investors to sign up to the Principles.

While consensus on the Principles was a significant first step, ESG metrics were only applied to alternative investment portfolios. Since this initial shift they have however consistently gained momentum over the years; over the course of 2020 ESG exchange-traded funds (ETFs) recorded a growth of 223% to $189 billion and over 200 new listings.

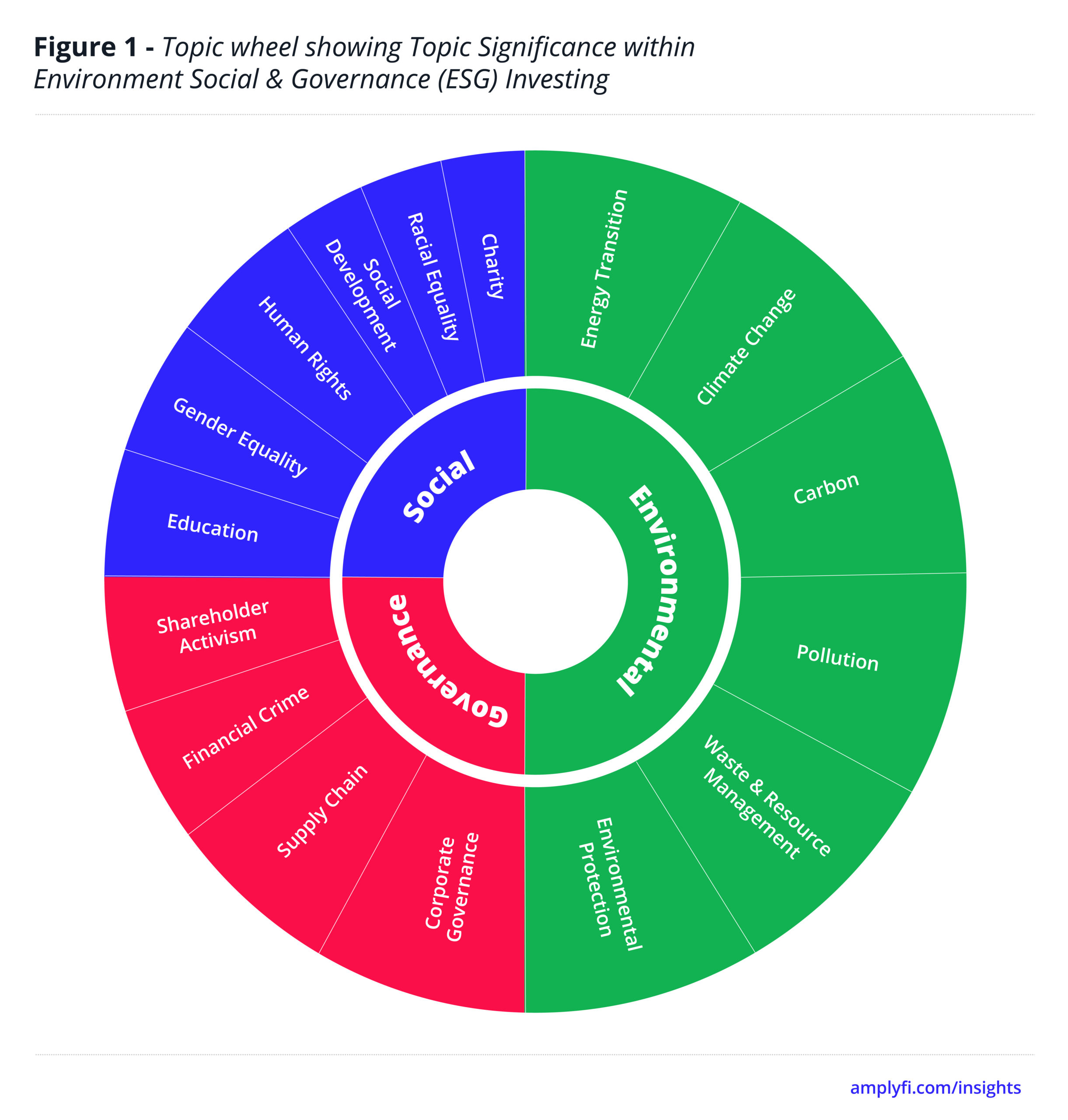

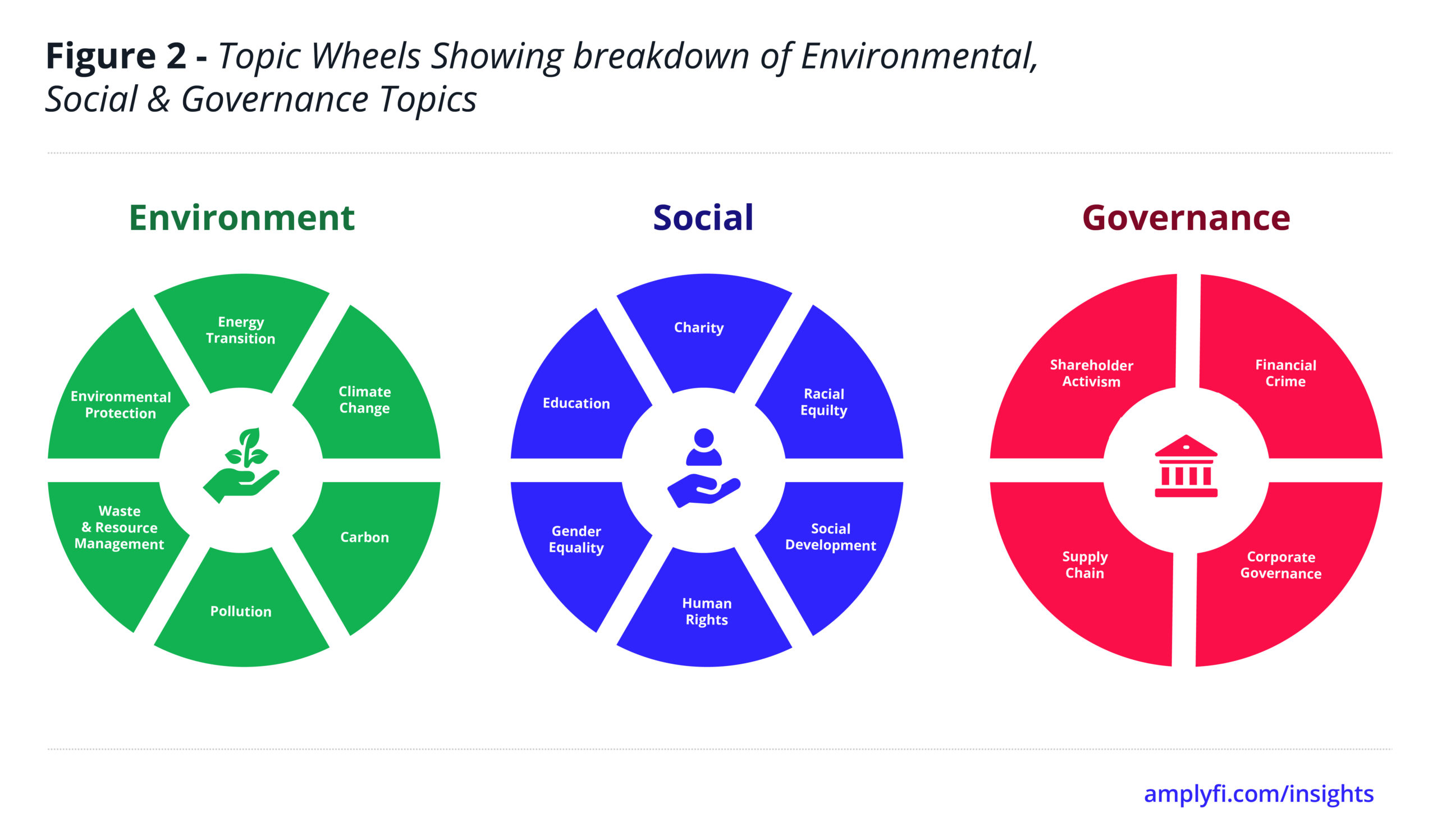

AMPLYFI’s analysis revealed environmental concern elements of ESG to be twice as significant compared to its social and governance concerns. Issues related to the energy transition, climate change, and carbon emissions are the most important topics within the wider environmental-related considerations.

The focus on the environment can be attributed to the devastating impact of climate change. In 2020 alone, aside from the pandemic, an unprecedented level of natural disasters have given further momentum to environmental metrics within ESG. Alongside devastating hurricanes in Central America and record-breaking earthquakes in multiple locations worldwide, bushfires claimed over 20% of the Australian forest, locust swarms in East Africa undermined food security throughout the region, and rising global temperatures caused Antarctic snow to turn green.

Investors are increasingly looking for prime investment opportunities geared towards combating climate change with “greening” of their portfolios a leading priority. In January 2020, Larry Fink, the CEO of BlackRock, stated in a letter to investors and other CEOs, that “climate change and investment decisions surrounding it will fundamentally reshape finance”. In the letter, he noted that “sustainability and climate integrated portfolios provide better risk-adjusted returns to investors and that sustainable investing is the strongest foundation for clients going forward”. Again in 2020, analysis by data provider Morningstar examining the long-term performance of a sample of 745 Europe-based sustainable funds shows that the majority of strategies have done better than non-ESG funds over one, three, five and 10 years with close to six out of 10 sustainable funds delivering higher returns than equivalent conventional funds over the past decade.

Such realities have given impetus to asset and investment managers to structure portfolios towards a lower-carbon economy. As such, the elements of the global energy transition that seek to tackle harmful greenhouse gas emissions i.e., deploying clean, renewable energy to displace fossil fuels, are central to ESG investing.

According to experts, energy transition projects focus on three broad fronts; primary energy production and conversion, distribution and storage infrastructure, and end use. For instance, this impact is evident in the transport sector which is among the top five carbon-intensive industries and, arguably, the most visible in terms of energy transition efforts.

Within the transport sector, there is both a growing consumer preference for electric vehicles and policy support to phase out fossil fuel-powered cars. Most European countries and US states such as California have put in place mechanisms to phase out internal combustion engine (ICE) vehicles through a raft of measures such as emission standards, taxation, and subsidies. In 2020, the UK announced a “command-and-control” measure that bans the sale of ICE-only petrol and diesel cars from 2030. Just this March, the UK restructured its subsidy policy to support more people access affordable electric vehicles.

A favourable policy environment and a clear shift in consumer preferences are the main reasons behind the increase in electric vehicle production; a trend that will strengthen as technology improves to reduce range anxiety and lower costs. The result is a growing need to develop charging infrastructure, whose supply chain includes different players in electricity production, transmission, and distribution.

AMPLYFI’s analysis found that supply chain management is the second most important consideration of the “governance” element of ESG investing. The average vehicle comprises around 30,000 parts either manufactured in-house or sourced from third-party suppliers. Among the key differences between conventional cars and electric cars is the power source. EVs use motors and batteries while conventional cars use ICEs and fossil fuels.

However, closer scrutiny of the charging infrastructure needed to support the full shift to EVs reveals gaping holes in the ESG claims of EV manufacturers. Firstly, EVs are currently not zero-emission as their lifecycle or “well-to-wheel emissions” need to be taken into account. This will only be achieved once power grids (power generation accounts for over 40% of global carbon emissions), manufacturing processes, and supply chains are all fully decarbonised.

Secondly, the batteries used in electric cars contain lithium and cobalt mined in South America, China, Africa, and some Central Asian countries. These are then transported throughout South East Asia to countries such as South Korea, China, and Japan, as well as Europe and the US. As the world increasingly electrifies, the growth in demand for batteries for use in multiple applications and devices is placing ever increasing pressure on the supply of the crucial rare-earth elements and minerals.

By 2040 demand for EVs is forecast to grow to 300 million vehicles globally (40 times its current state), while demand for batteries used in utility-scale energy storage applications is forecast to grow 38% annually to 2024 and continue to rise. In China, reports show that lithium mining contaminates local soil, water, and air, which leads to conflict, loss of life, and livelihoods. Cobalt, tin, tungsten, tantalum, and gold are considered to be “conflict minerals” since they are mined in environments often rife with armed conflict, corruption, and human rights abuses. Consequently concern is growing on the environmental and human impact of the extraction, sourcing, and supply of the key raw materials as well as the manufacture and assembly of key components resulting in multiple facets to ESG supply chain investing.

Clearly, a holistic review of the automotive industry supply chain shows that the environmental and governance factors are not yet streamlined to align with the ESG aspirations. However, it is important to note that a sound supply chain governance system may limit a company’s exposure to conflict minerals. Technologies such as blockchain will help to validate that procurement and supply has been conducted responsibly and sustainably. However, it will ultimately require the collaboration of governments, businesses, and other stakeholders to fully align the reality on the ground with ESG aspirations across the transport sector.

In terms of the “social” element of ESG investing, AMPLYFI’s analysis shows that the most critical factors are education, gender equality, human rights, social development, and racial equity as being the leading elements for consideration.

Again within the transport sector, research shows that gender and racial discrimination is rampant, especially in the delivery of the service. To combat the patterns of discrimination, Manhattan taxis are increasingly required to pick up any passenger while on duty irrespective of gender or race.

But enforcement of the directive remains challenging. AMPLYFI’s analysis shows that gender equality now has over double the significance of racial equality, meaning it is more closely associated with ESG. This is potentially a reflection of the #MeToo movement that exposed gender inequality and sexual abuse in Hollywood and other industies. However, with the murder of George Floyd and the subsequent global Black Lives Matter movement, social issues such as race have the potential to gain traction against the current environmental focus.