COVID-19 is still spreading in parts of the world. After a new wave of the pandemic swept Europe and America, the future of international aviation is full of unpredictable trends. Although some economies have contained the pandemic effectively and begun to resume production gradually, international air travel has barely improved as most markets in the world remain heavily restricted. The International Air Transport Association (IATA) predicted in April that airlines would lose US $314 billion in passenger revenue in 2020 due to the pandemic, rising to US $371 billion in June. The IATA has again lowered its expectations for a recovery in the aviation industry based on overall market performance in the first half of 2020.

Using Direct Data Services (DDS), the IATA has been collecting direct data from its 290 member airlines, writing industry reports and publishing structured datasets based on primary data. It’s regular aviation industry reports have been a direct and timely reflection of the current impact of the COVID-19 pandemic on the global aviation industry. The IATA typically uses horizontal and vertical comparison of data from multiple dimensions, such as flight attendant interviews, airline company market share and passenger travel intention, and outputs credible risk reports by monitoring aviation industry data. Although IATA data is widely trusted by the industry to show historical trends, structured datasets still have limitations. In particular, when it comes to predictions about future trends, the analysis of unstructured data may provide viable solutions to provide more accurate industry insights as the number of disturbances affecting the future increases.

Most organisations rely on traditional sources of business intelligence generated from standard structured datasets. Unfortunately, these signals often come too late. Especially when a black swan event like a global pandemic occurs, weak risk signals are difficult to capture by relying only on structured data. The emergency itself is unpredictable, and there is no historical data for reference, so the industry cannot implement meaningful, positive and timely response measures. However, before global events break out, there is usually a deep and extensive debate or commentary speculating on how evolving events or changing circumstances will affect markets. The challenge for traditional business intelligence is that these early signals are locked in unstructured data and, until now, it has been impossible to quantify them statistically and objectively.

AMPLYFI has used it’s AI-driven research platform to analyse unstructured content to extract and quantify topics highly relevant to the aviation industry in the context of the global crisis. AMPLYFI has analysed thousands of open source documents linking aviation to the impact of the COVID-19 pandemic, using a combination of natural language processing and machine learning to extract and impartially quantify the importance of each topic and entity discussed throughout the corpus.

Before COVID-19 wreaked havoc on the global aviation industry, unstructured data was sending signals. By March, China had contained the spread of the disease in its own country, but in the rest of the world, especially in Europe and much of the United States, there was no effective way to do so. World Health Organisation data shows that, as of the 19th March, the number of confirmed cases outside of China exceeded that within the country; COVID-19 had spread to more than 150 countries or regions, 15 of which had over 1,000 people infected with the virus. The global total of confirmed cases at the time was 209,839. Italy had become the most seriously affected country, while others such as Spain, South Korea, France, Germany and the United States were in a state of accelerated spread of the virus. The below figure is derived from AMPLYFI’s analysis of unstructured data surrounding the aviation industry. It shows that the topic significance curves of international and domestic flights are highly correlated with the trend of Coronavirus Cases. It is also clear that international flights were heavily impacted before domestic flights and to a higher degree.

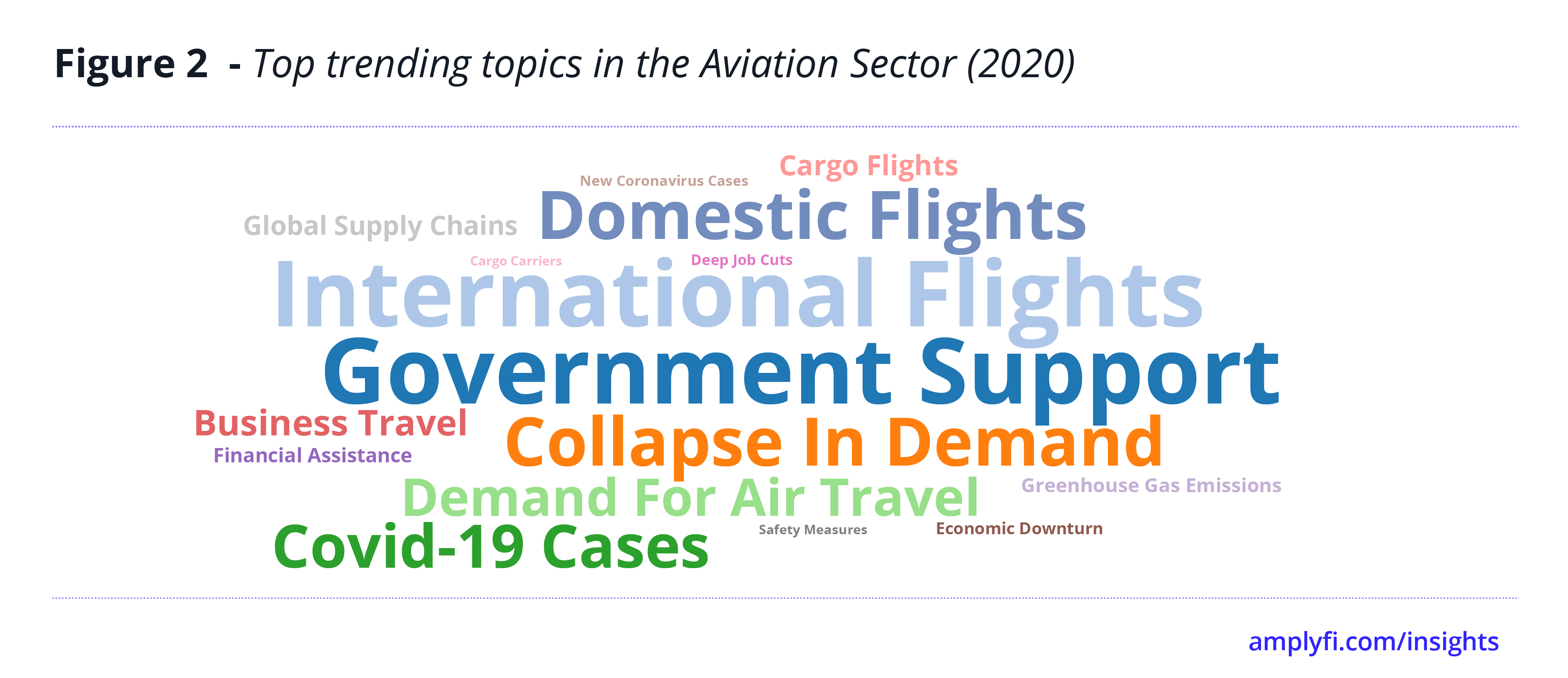

Obtained from the same analysis, we see the below Word Cloud reflects the size of some of the potential crises and challenges facing the aviation industry. In addition to international flights, some of the most notable key topics include job cuts, financial crisis, business travel, air cargo, aviation safety, supply chain, airline bankruptcy and a number of other issues.

However, as early as July 2020, AMPLYFI’s platform obtained results that gave a different insight. The aviation industry was showing signals of potential opportunities in the air cargo sector. Structured data sources such as IATA’s quarterly report, released in early November, confirmed this with a delay of 4-months. The IATA’s October 2020 survey of airline CFOs and Heads of Cargo showed that airlines remained in a difficult financial situation in Q3 2020, with record-low passenger demand and cargo demand improving slightly compared to the previous survey, but the upward trend remained weak. Still, the latest data showed cargo flights supporting current airline revenues, which are expected to grow over the next 12 months.

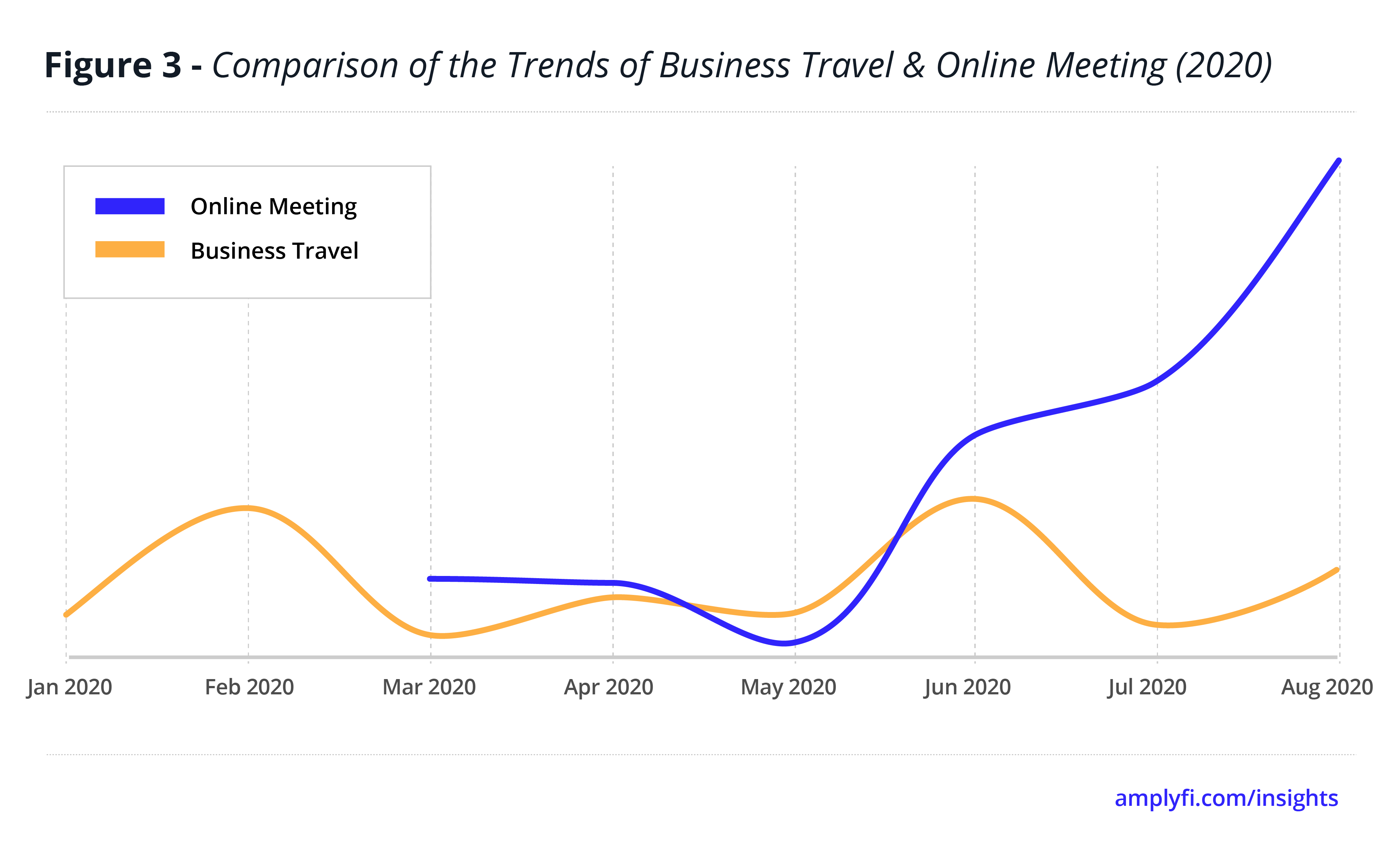

The economic impact of the pandemic on large airlines and their employees will be painful. The decline in commercial flights is the biggest threat to the airline industry, with business travellers accounting for about 5 percent of traffic and 30 percent of airline revenue. As companies cut budgets and imposed travel restrictions, business travel was replaced by video conferencing, potentially wiping out much of the industry’s revenue. AMPLYFI’s analysis can help to quantify this disruption, evidenced by the growing link between online meetings and the aviation industry in the below figure. As a comparison, the topic of business travel has oscillated month to month, but has remained relatively flat. These trends are likely to persist into the post-pandemic era.

In the latest hot topic, the aviation industry has once again sent out strong signals of risk. These risk warnings peaked in March and have once again been on the rise since July, although they declined as the first wave of the pandemic flattened out. Even before the latest round of European travel restrictions, the IATA predicted that global industry revenues in 2021 would be 46 percent lower than the US $838 billion in 2019. Additional government financial aid is crucial for airlines to ride out the virus crisis. Airlines are most likely to fail in jurisdictions with inadequate government policy support, according to Bloomberg’s analysis of airline finances around the world. It is worth noting, however, that there is a risk of losing jobs and pay rises when an airline takes action to protect itself from bankruptcy.

Datasets such as those available from the IATA provide a basis for industry and organisational decisions, but they often rely on survey feedback or limited structured datasets. AMPLYFI allows you to open large amounts of unstructured text data on the web. A combination of structured and unstructured data can help users gain deep insights related to any topic. With a fully implemented unstructured data analysis solution, industries will be better able to understand their current challenges. One strategic perspective of this study is that, although the global aviation industry is being severely impacted, regional economic recoveries could soon be boosted by future trade agreements after Brexit and the RCEP signing. These will provide opportunities for the recovery of the whole industry. By strategically applying structured and unstructured data, the industry may be able to mitigate some of the short-term disruptions, be alerted to the real crises, identify potential opportunities before competitors, and more effectively respond to future disruptions and move toward an earlier recovery.