Oliver is Head of Professional Services at AMPLYFI, leading the delivery of AMPLYFI technologies to our customers globally. Prior to joining AMPLYFI, Oliver held roles in energy market analysis and consulting.

Oil and energy markets are virtually inseparable from geopolitical events. From the multiple oil crises of the 1970s, the Gulf wars, 9/11, and now the latest Russian invasion in Ukraine, energy markets are once again being shaped by shifting geopolitical realities.

While the devastating human cost of the war being waged in Ukraine is the most urgent matter for policymakers and wider society, the globalised nature of energy markets means that few will be unaffected by the shockwaves rippling through the global economy as a result of Russian aggression. The impact on energy markets is particularly pronounced when the countries and regions involved are significant players in these markets. Russia, the world’s second largest oil exporter, is squarely in this category. But so is Ukraine, albeit to a lesser extent and not as a producer of energy, but as a host of critical energy infrastructure in Europe.

Experts and non-energy experts alike will be familiar with the dramatic impact this event is having. The effect of changing supply dynamics, economic sanctions, and shifting foreign policy objectives are hitting businesses and consumers through commodity price rises, inflation throughout the economy and all the resulting uncertainty.

But, what dynamics lie behind this, and how do they compare with the last period of significant price volatility, in 2014? AMPLYFI, using its technology platform, have conducted machine-learning analysis into the current market volatility, and compared this with an analysis of the global discussion from 2014.

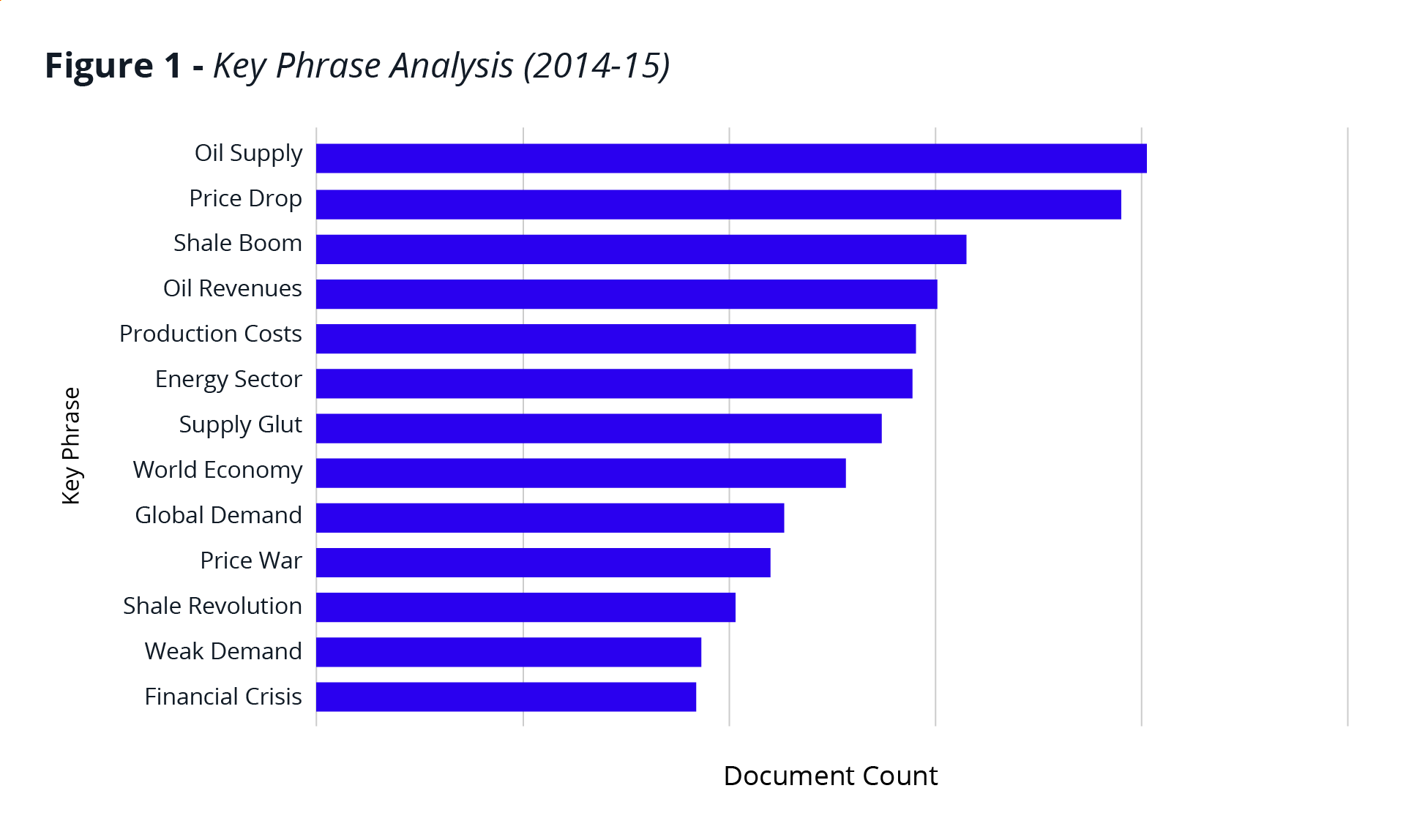

Key phrases identified by AMPLYFI’s analysis of thousands of documents from 2014-15 are shown in the chart below.

The data shows the prevalence of supply side dynamics, specifically the supply boom from shale production in the United States, which was a significant contributor to the price crash in 2014. Demand growth was apparent during this time but the increase of supply outpaced this, causing a rebalancing of supply and demand dynamics in favour of supply, resulting in falling oil prices.

Oil prices fell again in 2020, as a result of a dramatic fall in demand resulting from Covid-19 lockdowns around the world, notably in China, Europe and North America. Many economies had to be supported by increases in government spending and stimulus, which propped up demand and kept major economies afloat.

In the keyphrase analysis of documents from 2021-22, we see oil demand, Covid-19 and the invasion of Ukraine are all key factors. The documents analysed reveal that the vaccine-enabled global economic recovery (from the sharp declines into recession resulting from lockdowns) put enormous pressure on demand for goods and commodities, which in turn put pressure on supply chains, including energy.

A variety of factors such as domestic infection rates, the pace of vaccine rollouts and the presence of certain Covid-19 variants meant the transition out of lockdowns (often with very little warning) caused spikes in demand at different times in different regions. This resulted in uneven pressure on the supply of commodities and the supply chains connecting producers to consumers, further complicating an already finely balanced situation.

It is therefore not a surprise to see “tight supply” ranked highly in the 2021-22 data. The story of demand growth coupled with supply, and supply chain pressure, created the conditions for dramatic oil price rises. Then came the latest Russian invasion of Ukraine. The war has put pressure on many Western economies (particularly in Europe) to reduce their reliance on Russian gas following the Ukraine invasion. This contrasts sharply with the “supply glut” narrative evident in the 2014-15 data.

Discussion around the energy transition is a new topic in the 2021-22 data. Faced with the devastating impact of climate change, companies, policy makers and consumers need to be focussed on the road to net-zero while balancing the needs of society. Such dramatic events inevitably distract from longer-term goals around emissions reduction, but societal and political pressure for major economies to reduce their reliance on fossil fuels can take on a new urgency. Exports of hydrocarbons are key to Russia’s economy and, therefore, war effort, so there is an opportunity to accelerate this transition for European and other nations allied to Ukraine.

Further analysis of the 2021-22 data shows strategic reserves in the top 3 topics. This references the measures that the United States in particular is taking in response to the crisis. In March, the Biden administration announced that the US would release up to 1 million barrels per day (mbpd) from its strategic reserves over 6-months, up to 180 million barrels in total.

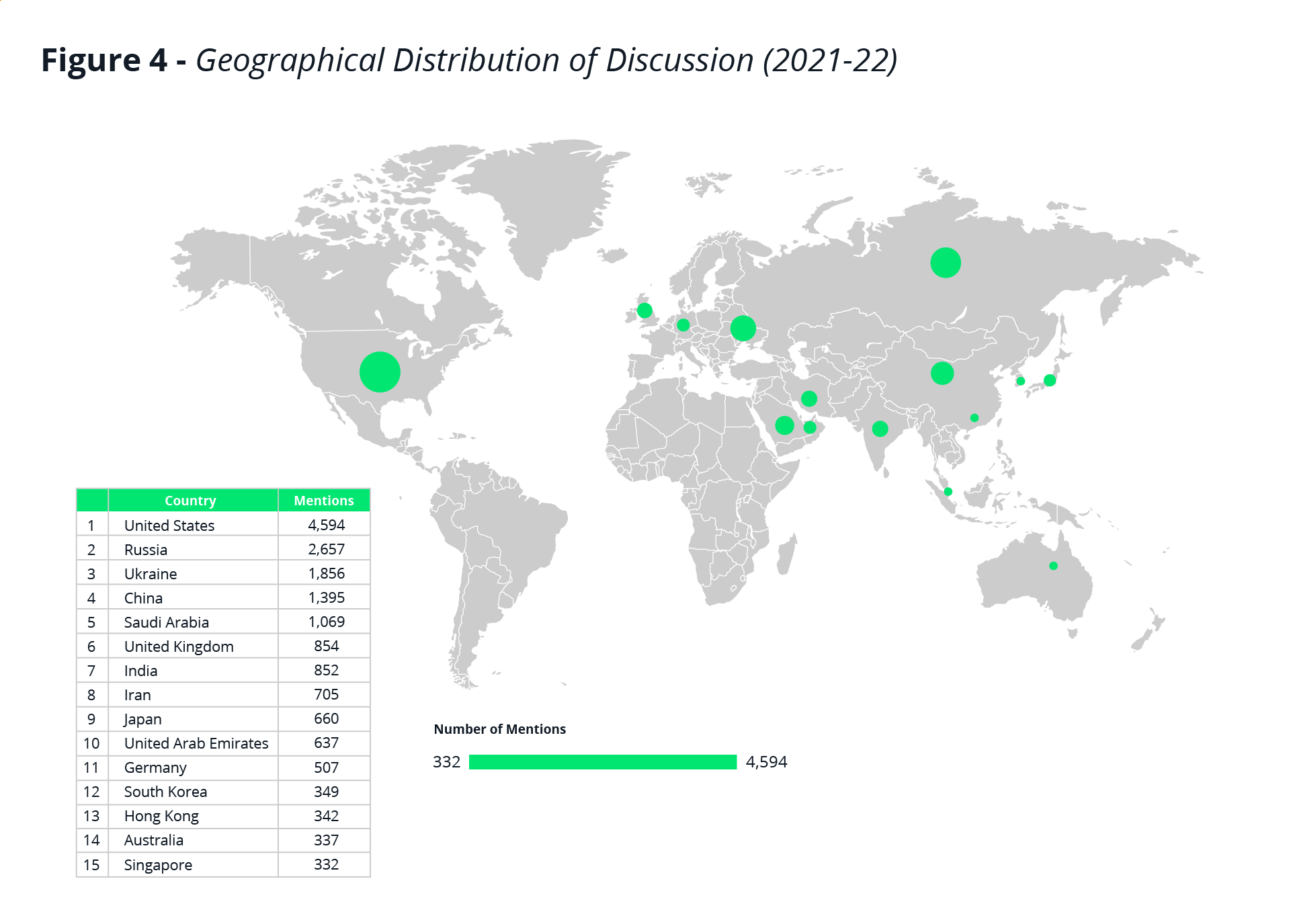

In addition to the keyphrase analysis, there is value for analysts in understanding the geographical distribution of the discussion to pinpoint the countries and regions who are impacted.

Members of the Organisation of the Petroleum Exporting Countries (OPEC) are consistently well represented in the document corpus, given their importance as oil exporters and how OPEC policy shifts market dynamics. However, the US and China are also dominant as the world’s two largest economies, and as a result key drivers of supply and demand globally.

Ukraine is unsurprisingly listed in the top 3 in the 2021-22 data, displacing Saudi Arabia, the world’s largest oil producer and a leading member of OPEC. Ukraine also appears in the top 10 in the 2014-15 data, again this is the result of Russian military action against the country in 2014, which led to the annexation of Crimea.

The United States and China are in the top 5 results across both data sets. This is a reflection of their importance as demand centres being the two largest economies in the world, and in the case of the United States, as a major oil and gas producer.

Germany also appears in the top 15 in the 2021-22 data where it was absent in 2014-15. This prominent position in part reflects Germany’s economic supremacy and political influence in the EU and throughout Europe. But Germany is heavily reliant on imports of Russian gas and its decision to halt the development of the Nord Stream 2 gas pipeline from Russia to Europe was a clear signal of major change in the direction of foreign policy for Chancellor Olaf Scholz. It’s clear the Russian invasion will redefine the political order for Europe and Russia.

Energy markets are turbulent and open to volatility from political, economic and societal events. This fact has been brought into sharp focus due to the Covid-19 pandemic and the Ukraine-Russia conflict, while the energy transition gathers pace.

AMPLYFI’s research platform enables a deeper analysis of the key dynamics and emerging trends that are shaping energy and geopolitical realities – and crucially – allows for continuing monitoring of the situation as it evolves.

As the war in Ukraine continues and geopolitical order shifts, it is clear that there is more uncertainty ahead and energy markets rebalance as Western nations turn away from Russian exports. This backdrop of ever-changing political and economic influence, coupled with the speed and nature of the energy transition, will go a long way to determine which key players emerge as leaders in the space in the coming decades.