We’ve analysed news around VR to explore the current landscape of discussion around the technology

Virtual reality enables a computer-generated simulation of a realistic 3D environment, with users interacting with the environment using equipment such as Head Mounted Displays (HMDs) or haptic interfaces, which alter a person’s perception of reality.

While the VR market has continued to grow through the years, it has recently missed growth projections. For instance, predictions showed that the market would grow to US$26 billion by 2022, but the present-day VR market value is $11 billion. With only 15% of the US population using VR, the technology is yet to go mainstream.

Using AMPLYFI’s AI-driven research platform, we’ve analysed thousands of news documents and found key trends in the current discussion around VR.

VR was initially used to enhance gaming. But now, it is expanding into almost every facet of life. In healthcare, doctors are beginning to use the technology to plan complex operations by performing surgeries in a simulated virtual environment before the actual process. It also has the potential to transform education, giving students memorable and immersive experiences, such as visiting historical monuments without leaving the classroom.

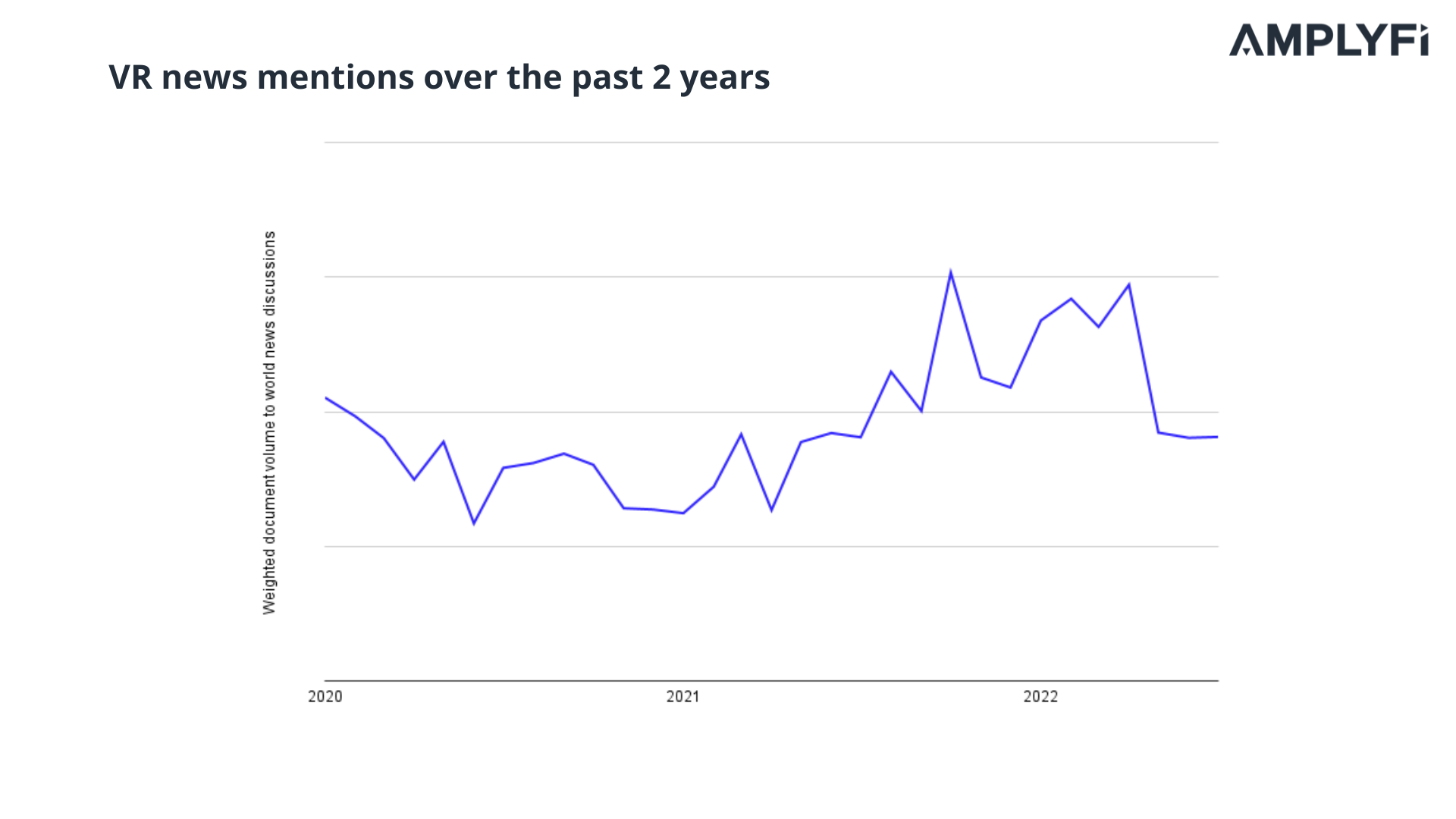

Our analysis reveals that VR news discussions have followed three distinct trends.

News over the past two years highlights interesting dynamics in VR’s trajectory. For example, we see a decline in the media discussion between 2020 to 2021 due to the onset of the COVID-19 pandemic, when global news shifted to focus on the pandemic.

However, this trend could be seen as unexpected. With the pandemic causing a rapid adoption of digital technologies, it would be expected that VR would have been leveraged more globally as a means of digital connection. The discussion then started growing in May 2021, hit a plateau in November 2021, and then declined steadily from April to July 2022.

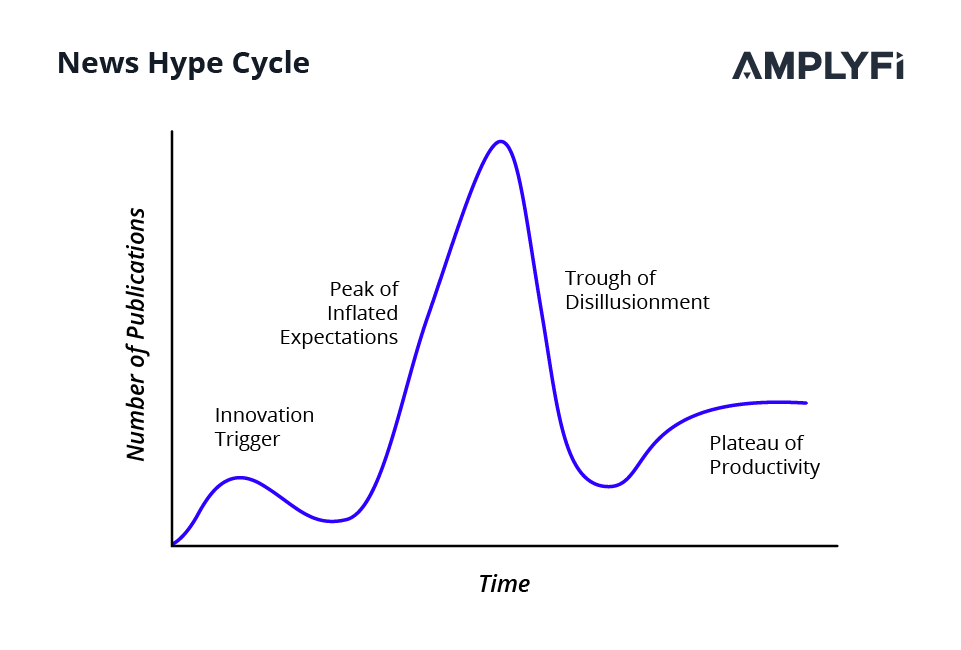

Gartner’s hype cycle for emerging technology and AMPLYFI’s approach to approximating technological maturity could explain this trend.

These frameworks measure a technology’s maturity, usually evident in widespread adoption and cross-industry application. While the direction from the first figure above shows the news trailing off, juxtaposing it with the hype cycle shows it could just be the natural course of a technology approaching maturity.

If we take the 2021-2022 section of the VR news mentions, we can see that it represents a thin slice of the hype cycle. In this period, the trend starts at the bottom of the hype cycle’s trough of disillusionment and rises into the plateau of productivity.

VR was first invented in 1965, and for the 50 years following, people had elevated expectations on when and how the technology would transform everyday life. The industry did not appreciate how long it would take to figure out and build the necessary technology. Afterward, from mid-2020 to the end of 2021, the trend entered the trough of disillusionment. During this time, though the technology had started to deliver value, certain factors, such as hardware costs, hindered mass adoption.

One key aspect which previously limited VR from advancing was its adoption. Initially, VR headsets and software were too expensive for the mainstream market, with a headset costing almost US$1,600. But the situation is rapidly evolving:

- New players (like Nvidia, HTC and Samsung) are entering headset production.

- Use cases are ever-expanding – recent developments include cognitive behavioural therapy in psychology.

- Standard smartphones are now being built with an increased capacity to handle VR content – quality headsets can be as little as US$20.

Between June and November 2021, there was a slight uptick in news mentions

This came as social media giants began to embrace VR’s possibility to facilitate social interactions:

As social media companies embrace the possibilities of VR and HMDs become more accessible, it’s only a matter of time before the industry overcomes the snag in adoption and the technology becomes mainstream.

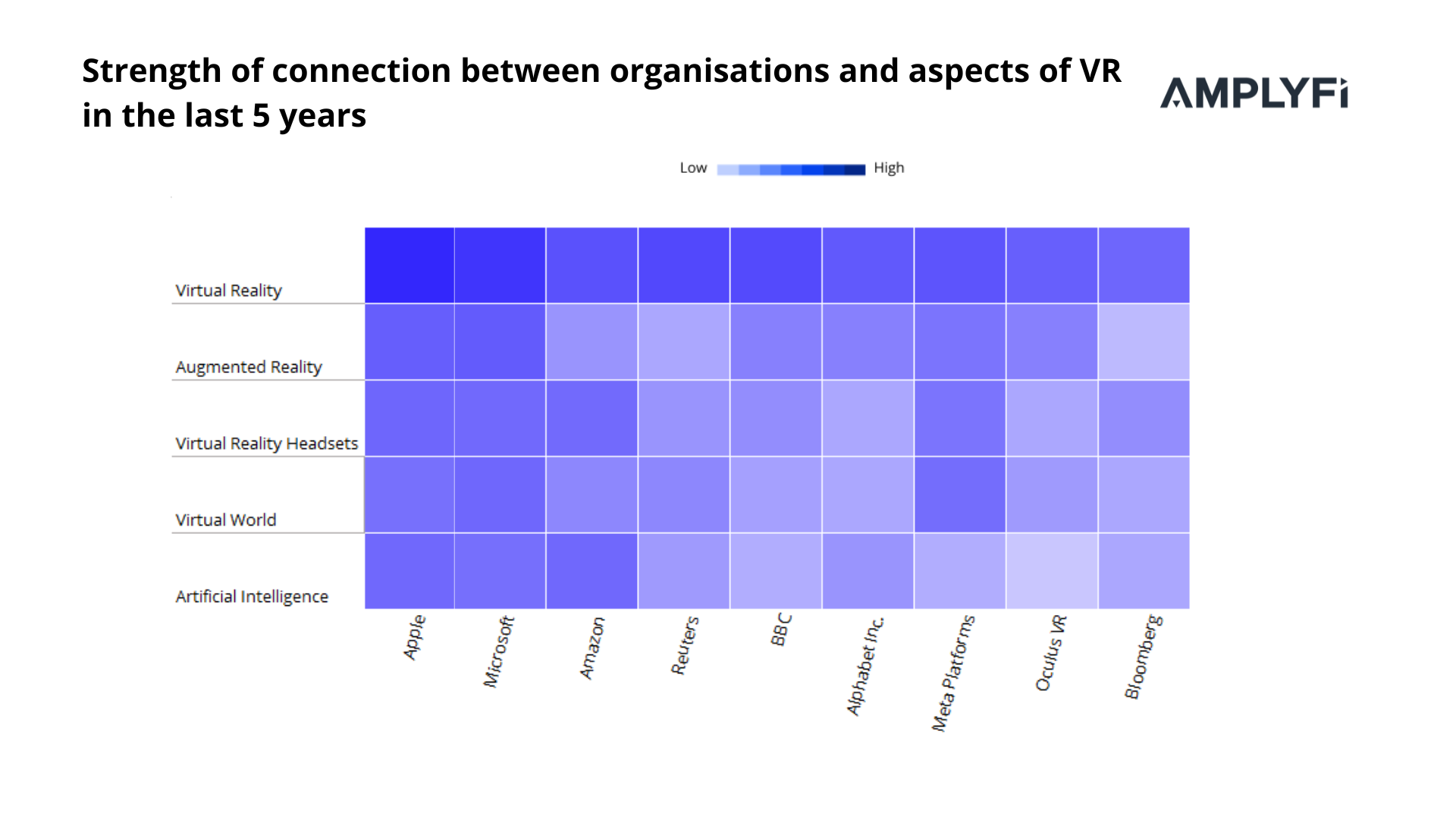

The analysis also revealed the strength of the association between leading companies in the industry and specific aspects of VR. Such associations signal the progress companies are making.

According to the insight, Apple has the strongest connection with virtual reality, while Bloomberg and Oculus VR have the weakest. Apple, Meta and Microsoft emerged as frontrunners in the VR space, having a strong connection to the topics of augmented reality, virtual reality headsets, the virtual world, and artificial intelligence.

Interestingly, all these players have a role to play in solving the challenges around VR mass adoption. Consumer-facing tech companies like Google, which owns Alphabet Inc, and Microsoft have entered the headset-making space, a positive step towards making equipment accessible to the average internet consumer. Reuters and BBC are becoming increasingly involved in the technology and could be making VR content for public consumption soon. For instance, BBC is collaborating with key industry players on a selection of VR and 360-degree video projects.

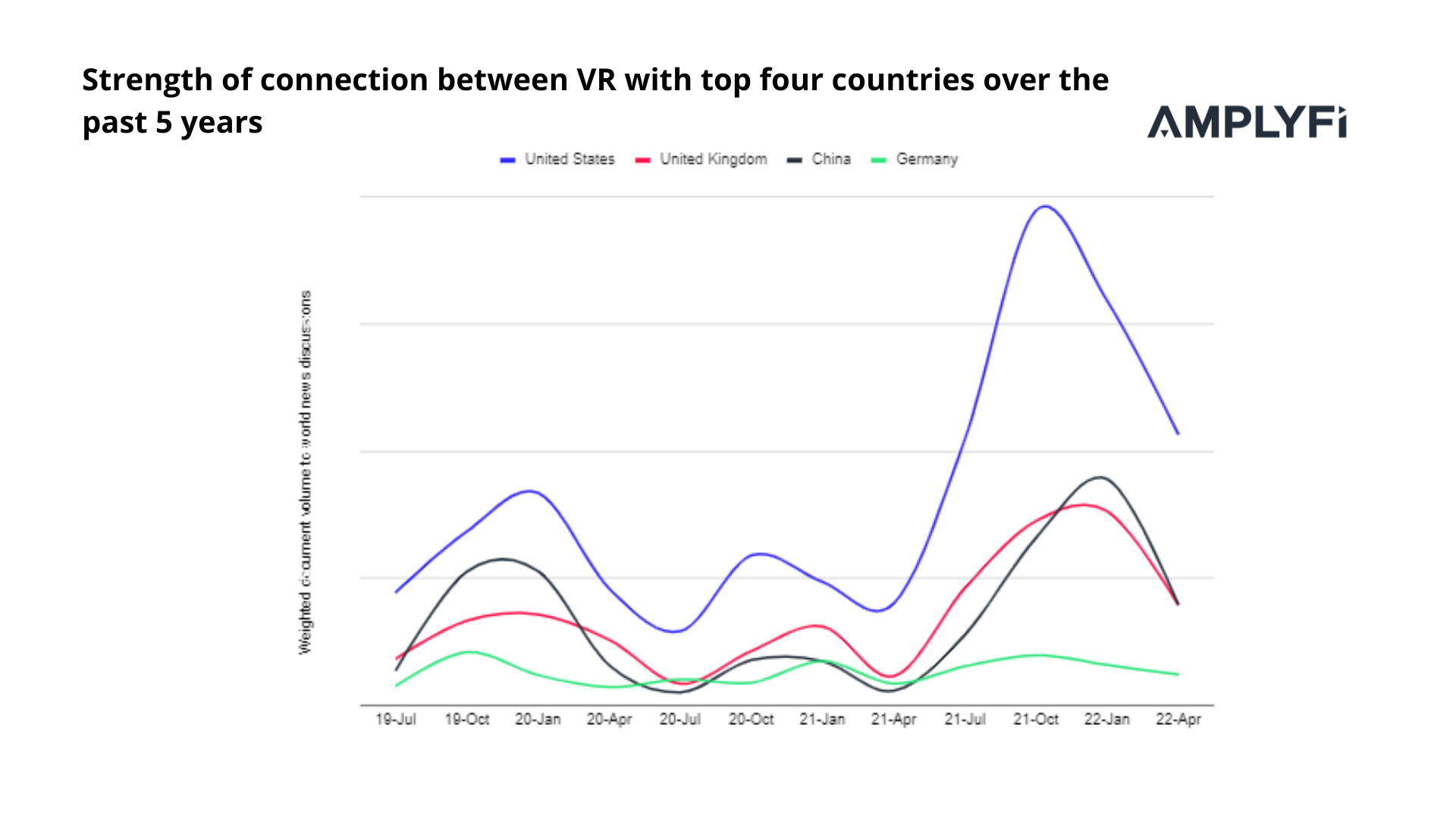

The US, China, the UK, and Germany are the countries most strongly associated with VR in the news.

Interestingly, the trend shown in the strength of connection for these four countries is similar to the global trends in mentions reflected in the first insight.

From the insight, the US is massively leading the way, almost double the size of the other countries’ peaks. This is likely due to leading tech companies, such as Meta, Apple, Google, and Amazon, being headquartered there.

China and the UK’s association with VR seems to move in tandem, whilst Germany sees much lower peaks in VR documents. A trajectory of VR mentions in all the featured countries shows that after an initial hype, mentions often stagnate.

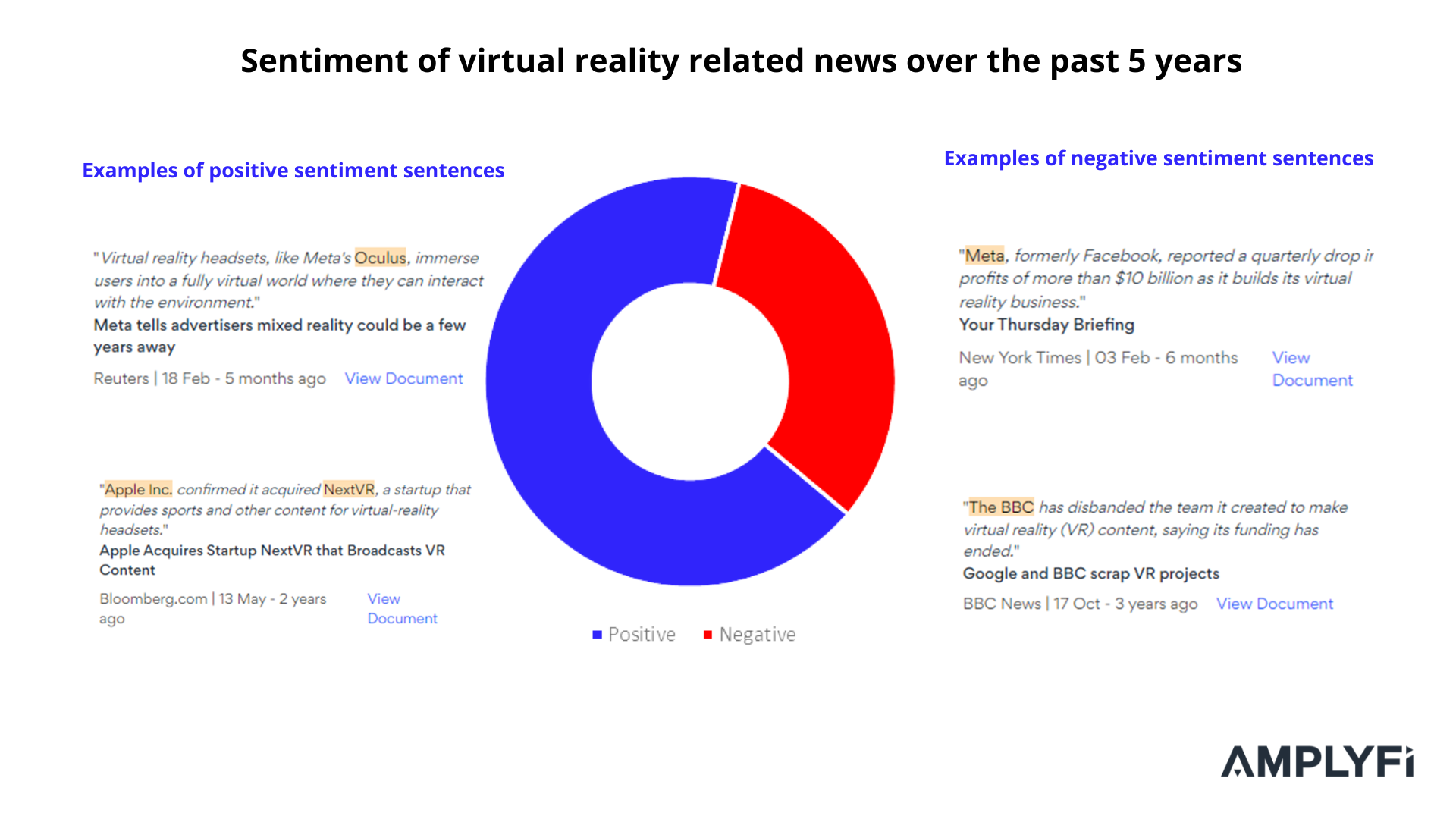

The overall media sentiment around virtual reality is positive.

Positive sentiment in VR-related news includes discussions about social media platforms and tech giants and their current achievements in the VR space. This may signal that mainstream social media and tech organisations have entered the race to make VR content and hardware more accessible for general consumption.

The negative sentiment sentences reflect businesses’ challenges in generating meaningful revenues from VR investments – Meta reports a quarterly drop in profits, and the BBC disbanded its VR content team.

Though promising, virtual reality has a long way to go before it becomes mainstream and starts bringing in profits for the businesses invested in the technology. As the prerequisite infrastructure becomes more affordable in the coming years, we will likely see the technology beginning to be applied across multiple industries.

Whilst VR may follow the hype cycle, its technological maturity may not follow a linear progression from an innovation trigger to the plateau of productivity. For VR, likely due to the complexity of the technology, the technology had settled at the plateau of productivity from November 2021 to May 2022. But the tail end of the graph suggests that as new players, such as social media companies and news agencies, enter the space, the technology may re-enter the trough of disillusionment as these new companies work to add value to the industry and potentially launch the age when VR becomes mainstream.