Supply chain resilience is more critical now than ever before, not just to businesses but to whole economies too, and the pressure for them to change is greater than ever. An elaborate network of businesses, activities, technologies, individuals, information, and resources, supply chains spread over single or multiple countries and are organised to deliver a product or service to consumers. Their resilience refers to the design or measures put in place to improve the ability of a supply chain to withstand or promptly recover from planned and unplanned disruption.

Whilst linear supply chains have existed since the dawn of commercial trade, they are now widely accepted as being highly susceptible to interruptions that can severely impact businesses and livelihoods. Supply chain interruptions include black swan events, such as natural disasters or accidents, pandemics and resource constraints. Linear supply chains are also exposed to favourable or unfavourable policy changes. Disruption from events such as climate change and COVID-19 have demonstrated just how open companies are to operational, commercial, and reputational risk when their supply chains are not resilient. Using AMPLYFI’s AI-driven research platform, we have unearthed unique insights into the landscape of supply chain resilience. Our technology leverages machine learning and data science to deliver insights by analysing and making connections across structured and unstructured data at scale, uncovering the hidden links, trends and opportunities.

Our analysis revealed that the prominence of supply chain resilience in the news has been increasing since 2017 (see Figure 1). Whilst the discussion surrounding the topic was already increasing, since the start of 2020, COVID has dominated the discussion. However, from 2020 to 2021, the relative volume of supply chain resilience discussion has dropped, likely due to the world adapting to post-COVID and some supply chain “normality”. In correlation to this, we can see an increase in the percentage of documents that do not mention COVID increasing from 20% in 2020 to 29% in 2021.

The World Economic Forum’s (WEF) 2021 global risks report ranks short to long term risks based on present realities and challenges. According to the report, in the next two years, the impact of COVID-19 will become increasingly evident and undermine gains made towards addressing inequality and poverty achieved over the past twenty-five years. Cyberattacks, weapons of mass destruction, the collapse of states or multilateral institutions, and climate change are among some of the leading risks anticipated in the next three to five years. Also, within a five-year timeframe, the world may experience a debt crisis, and commodity and price instability. Only those supply chains that are inherently resilient will remain relatively unscathed.

Supply chains function on principles of efficiency and specialisation, with models typically consisting of layers of participants with producers of natural resources and raw materials providing feedstock to Tier 3 suppliers or manufacturers. Supply chains, particularly those that are linear in nature and lack resilience are extremely susceptible to any in-country or regional instability that impacts any of its tiers. China, often considered to be the leading tier-three manufacturing country, is central to producing the raw materials and constituent parts needed for electronics, pharmaceuticals, medical equipment, and consumer goods across the world. Holding abundant reserves of the ‘the 90 elements that make up everything’, its position is underpinned by long term strategic central planning, favourable national policies, and plentiful labour resources.

Given China’s central role in global supply networks, any in-country disruption can have adverse ripple effects throughout the world. For instance, since COVID-19 hit, global drug supply chains have had to contend with disruptions to the flow of raw materials caused by lockdown mitigation measures. In the US and UK respectively about 80% and 70% of the Active Pharmaceutical Ingredients (API) used for making drugs come from China and India. In addition, of generic drugs consumed in the United States, 90% come from China, while 40% come from India. One of the significant effects of the pandemic in these countries that both suffered severely was to create shortages in the supply of critical drugs that, in turn, hampered patient care in countries of the European Union, the US, and the UK.

Similarly, the Suez Canal (accounting for 12% of global trade including crucial energy sources such as oil, gas, and natural resources) blockage in which the Ever Given cargo ship blocked the passage in early 2021, emphasised the importance of single points of failure in transportation routes. In addition to the cost of delay in delivering the Ever Given’s own cargo, the blockage also created additional fuel and other costs to ships that had to be re-routed. At a time when global supply chains were already stressed by COVID-19, global markets were further affected by this single event. For instance, the oil market alone witnessed a 4% price increase. The obstruction qualifies as one of the most recent black swan events, an unpredictable event with potentially severe consequences.

Rapid changes in consumer demand and behaviour can also disrupt supply chains. During the COVID-19 pandemic, particularly in the early stages, demand for laptops, tablets, and other consumer electronics jumped, driven by lockdown and “stay-at-home” measures. This, in turn, placed pressure on the availability of semiconductors. Even when COVID-19 infection rates were falling, demand dynamics continued to change in the automotive and consumer electronics industry. With consumers anticipating that companies would continue work-from-home working practices under a new trend of flexible and hybrid remote working arrangements, demand for semiconductors in consumer electronics continued to soar. As a consequence, whilst the automotive industry witnessed a sharp decline in vehicle demand at the start of the pandemic, when demand did start to rebound, a lack of semiconductors hampered efforts to ramp up vehicle production.

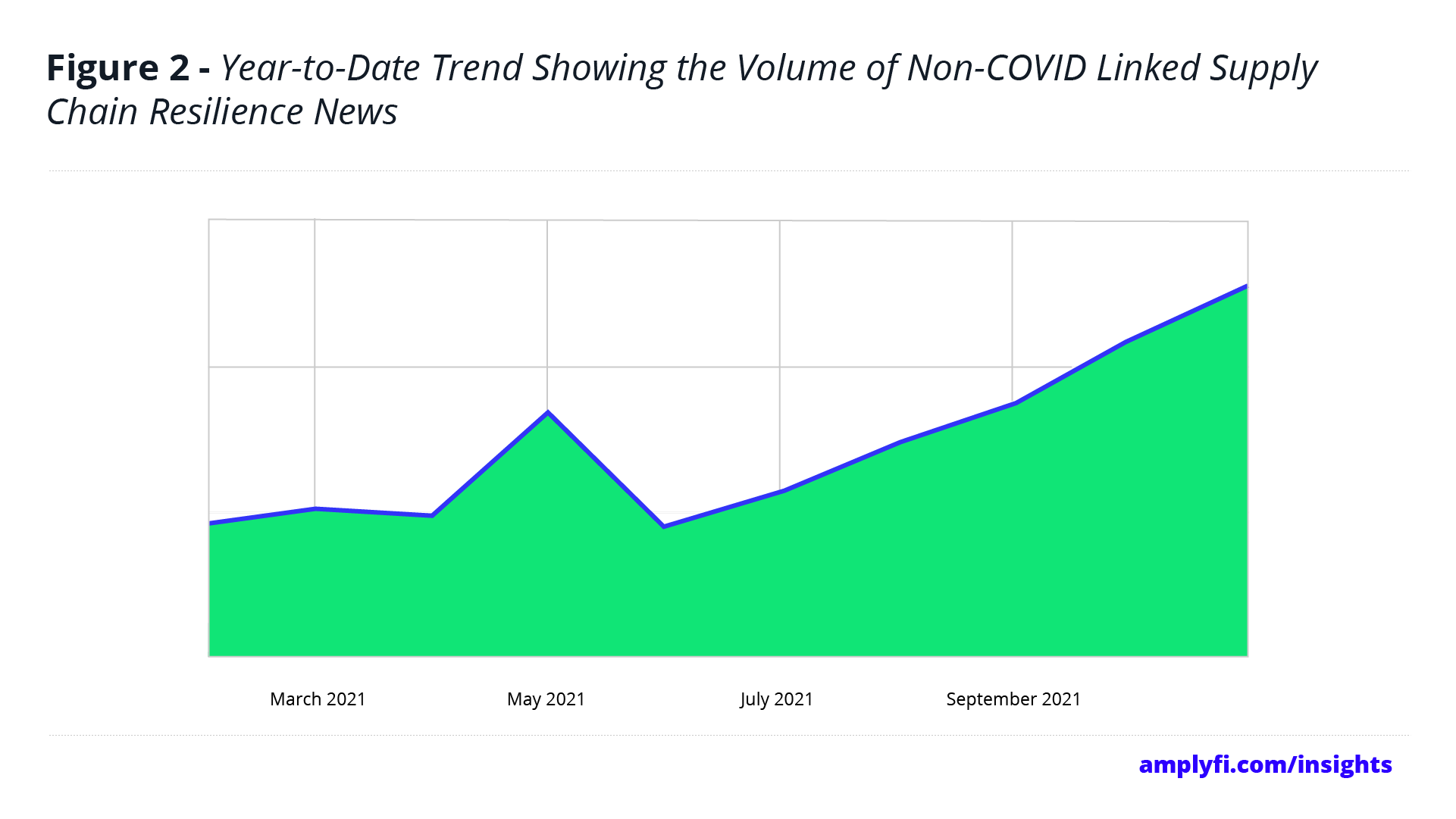

Despite it’s key role in shaping recent supply chain disruptions, the COVID-19 pandemic is not the only driver of discussion in the supply chain resilience space. AMPLYFI’s AI-driven analysis platform revealed that the volume of non-COVID linked supply chain resilience news has tripled from June to November 2021 (See Figure 2). Whilst COVID has dominated 2020 and 2021, amongst the documents driving our analysis, the biggest driving force of non-COVID discussion is Climate Change.

Another trend in supply chain resilience is an acceleration in the adoption of digital technologies by both big and small businesses, which has likely been driven by the pandemic. Between December 2019 and July 2020, a McKinsey study highlighted significant growth in the share of digital products offerings with a 7-year average leap in the rate at which companies developed digital products and offerings.

This trend is very much reflected in supply chains. Prior to the pandemic, data indicates that over 55% of logistics companies have already invested in warehouse automation. Should this trend continue to see digital supply chains embraced and fully automated, it will result in greater collaboration between participants and greater resilience.

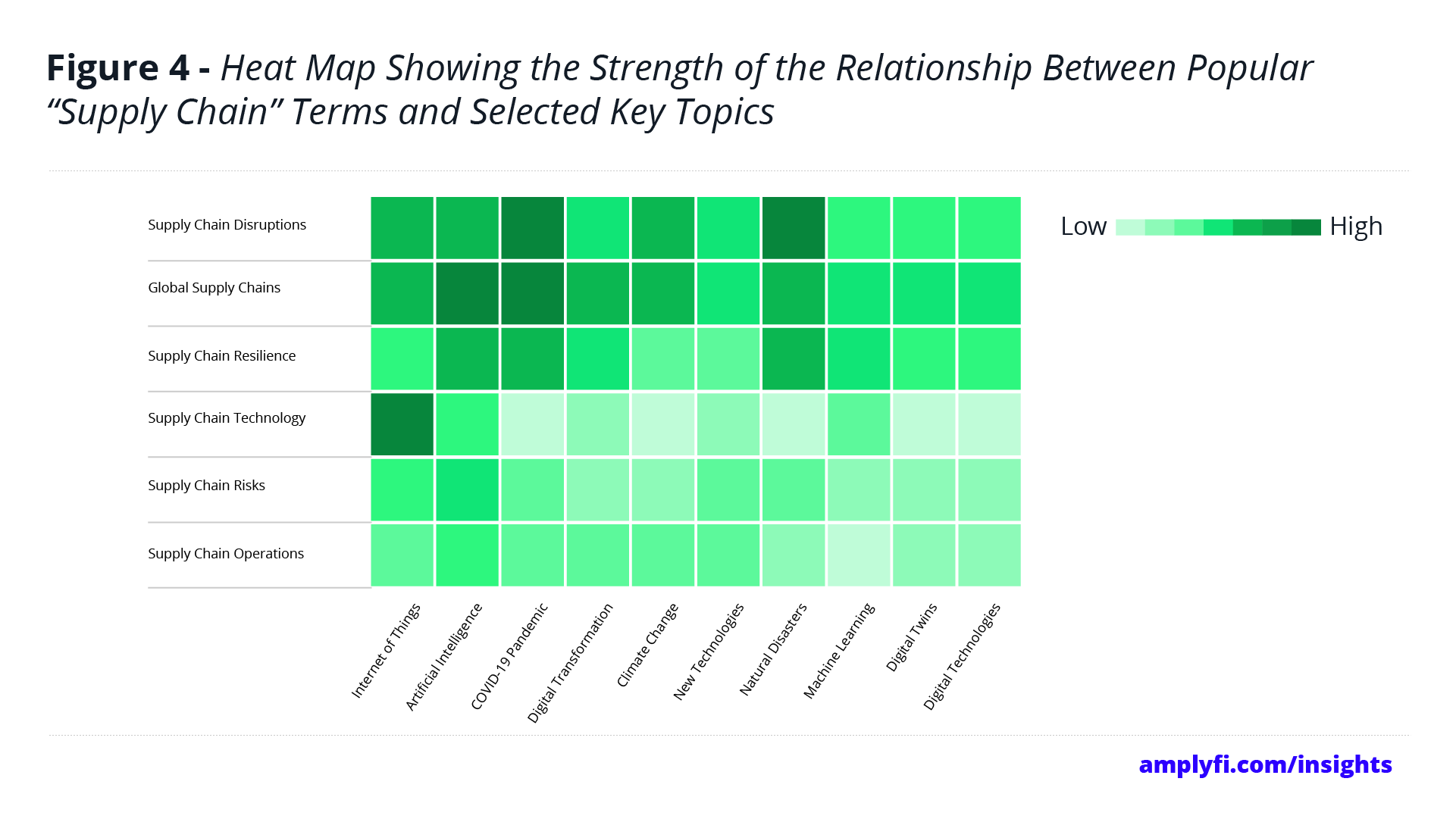

According to McKinsey, Supply Chain 4.0 will leverage the Internet of Things (IoT), advanced robotics, blockchain technologies, and advanced big data analytics. AMPLYFI’s analysis also indicates this trend, with IoT emerging as a key supply chain technology in the past five years (See Figure 4). In our analysis, the two key phrases most linked to the term ‘Supply Chain Disruptions’ were ‘COVID-19 Pandemic’ and ‘Natural Disasters’. There is also a particularly strong link between the Internet of Things and Supply Chain Technology, with Machine Learning less significant than both IoT and Artificial Intelligence.

Supply chain resilience is now more important than ever, especially in light of recent global disruption from COVID-19, geopolitical realignment, and the emergence of new technologies. Following the disruption from the pandemic, there are signs that efforts are being made to reduce supply chain risk. Initiatives such as the 2020 US-Mexico-Canada Agreement (USMCA) that promote cross-border collaborations and level playing fields for suppliers have the potential to transform supply chain dynamics.

However, will the current measures being implemented truly deliver long term resilience or will supply chains gravitate back to how they were before the disruption? In 2011, an earthquake hit Japan causing the Fukushima nuclear disaster and disrupting global supply chains, particularly the automotive industry. This caused many players to rethink their strategies to better prepare and respond to the next supply chain threat. The automotive industry experience under COVID-19 suggests that the plans and lessons learned in 2011 were either poorly designed, never implemented, or allowed to lapse as participants sought to reduce costs or circumvent market inefficiencies introduced by trade initiatives such as the USMCA.